In the past few years, ESG investment has become popular, which further has had a major impact on how investment capital is used throughout the globe and also presents challenges to accepted standards of business that were previously followed with Cuibonsense: what used to be led by eco-friendly investors to add conscience into their electorate is now also a mainstream trend and by consumers become part of managing social capital, state policy in both financial terms. ESG investment is redefining the landscape of capital investment with major implications for businesspeople, investors and sustainable development in the future.

Understanding ESG Investing

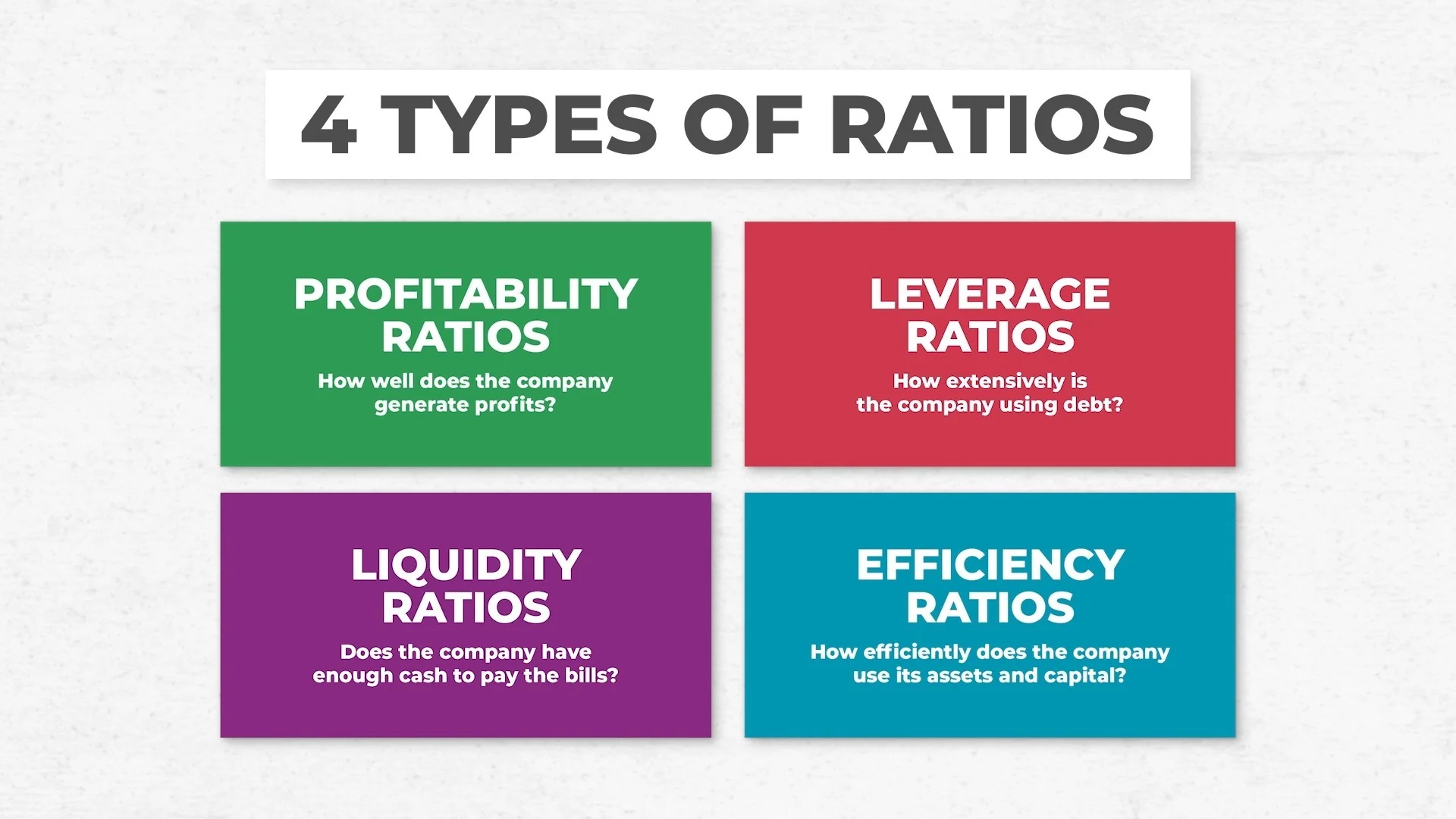

ESG investing investigates not only a company’s financial performance and how it manages risk, but also the environmental, social and governance (ESG) criteria of these.

The environmental criterion is concerned with how a business impacts the environment. This includes all measures taken to reduce its carbon footprint, the management of hazardous by-products and wastewater discharge; likewise attitudes toward renewable energy sources. The “S” part of ESG comprises companies’ relationships with their employees, customers and suppliers; and relationships to communities where they operate. It’s about labor practices, diversity and inclusion (or not), human rights and consumer product safety. Issues in governance have to do with the structures and processes that steer a company’s decision-making as well. About governance practices, there are any number of convenient examples. In the interests of economy these should be restricted down to three: composition of boards (within this wide-ranging diversity), reward policy for executives (within limits), shareholder rights.

ESG investing is not just a matter of avoiding companies with a bad record of ethical behavior. On the contrary, it is positively seeking out those businesses which are capable of putting such principles into practice. By so doing, this mode of investment links financial goals to social objectives and in that way can make a contribution toward creating a world that is more humanely habitable.

The practice of taking into account a company’s environmental and social performance in deciding where to invest really took off over theist decade.

According to the Global Sustainable Investment Alliance, sustainable investment totaled $5.3 trillion worldwide in 2020, accounting for over a third of all assets managed by professionals. Especially striking is the growth at institutional investors, such as pension funds, endowment funds and sovereign wealth who are increasingly building ESG measures into their investment poor featifferent reasons behind the development of ESG investment.

Change of Climate:

Greener investments are sought as climate change and environmental destruction drive concern. Thus, investors want to promote companies that are reducing their environmental impact. This can be affected by either reducing carbon emissions, sowing the seeds of renewable energy sources, or turning farming into an undertaking which does not harm the environment. Social Responsibility and Individual Case: Indeed, the international restudy of problems like race relations, workers ‘rights, and consumer rights has not only raised social responsibility to a top priority of fund investors but also resulted in businesses ‘giving a little precedence to societal norms again as well as receiving huge funds to make this change possible for them Businesses that promote living wages, ethical supply chains, and a corporate culture sensitive to all forms of prejudice find themselves with substantial capital underneath them.

Hard and Fast Rules Calls:

New regulations are now being introduced throughout the world which require business to disclose more stuff about their ESG performance. For example, the European Union’s SFDR (Sustainable Finance Disclosure Regulation) stipulates that there should be not only fair disclosure of ESG risks and opportunities but practical and easy-to-follow disclosureas well. U.S. Securities and Exchange Commission (SEC) is also setting higher and higher standards for ESG reporting where such standards are required. Performance: Outstanding Over the long run, it is clear that businesses with a strong track record on environmental, social and governance standards can out-performer rivals who trade in everything but fairness. This is because with stringent controls already in place to begin with, they can withstand environmental hazards quite well and recreants scorn reproach. And besides that, perhaps they operate with business models that are built to last nowadays also because people are getting more inclined towards sustainable living.

Changing Investor Market:

Now entering the investment world are Millennials and Gen Z, both groups particularly concerned with sustainability. These new investments are aimed at broader categories of the population. This shift towards what might be termed syndication investing–not guaranteed–will give investors more options than ever before as to where they want to place their money, and also so many alternatives that it is almost as if everyone were using these public mutual funds.

Esg and corporate behavior

Esg investments have received more and more followers. The climate change agenda is pushing some companies to recalibrate their corporate structures of domestic testing-mechano synthesis such restructuring offers firms not only an ethical duty but also chance to pamper an investor and collect higher return on investment in later periods.

For example, companies which adopt ‘green’ practices such as decreasing emissions or substituting renewable energy sources can reduce their impact on the risk from climate change. Similarly, businesses that focus on issues of social justice like fairness in personnel practices and diversity initiatives are likely to have lower turnover among workers as well better public trust. Only through robust risk control and disclosure can effective governance enable companies to steer clear of the regulatory challenges and win over investors demanding a stable and straight-dealing company.

A major trend to watch is the growing number of corporate social responsibility (CSR) reports, series of a lets say enterprise’s ESG enterprises classified by kind. Today not only do countless companies produce these pieces more permanently as appendices in annual reports (though there are also some who bus that only a sustainability report). Such disclosures allow investors to see how well companies are managing ESG risks and opportunities.

The Impact of Esg on Financial Markets

Esg investment has not only changed the structure of individual firms; it is remaking the entire financial market and investing environment. Just a few examples are sufficient to demonstrate how ESG is increasingly becoming a consideration for financial decision-makers:

Investors are rushing with such abandon toward these products that some are prepared make do themselves in their portfolios, even with their budgets.

Green Bonds: Green bonds are a debt instrument that started out of a desire to finance the environment-helping type of projects. The green bond market is increasing rapidly. In 2016 alone, the global issuance of green bonds exceeded US $500 billion in size—a fact both the private sector and sovereign entities use to fund projects in sustainability.

Sustainable Indexes and Ratings ESG indices such as the MSCI World ESG Index and FTSE4Good have grown into major benchmarks for responsible investment. They permit investors to see’,

Risk Management ESG factors have now become an important part of risk assessment. Investors are mindful of the environmental changes, such as water pollution and greenhouses gases, social unrest in countries caused by unemployment or poverty, and poor corporate governance that may lead to fraud or corrupt practices cropping up that affect financial performance.

In the area of Risk Management, increasingly they are looking at ESG factors. Fat Cats and Consumer Activists: Investors are using their votes more and more to push companies towards better ESG practices from within. In recent years shareholder motions on climate actions, executive pay and board diversity have all become more common, with even institutional investors wielding influence on companies to encourage them to “green up” or do other things that can contribute toward sustainability.

Challenges and Criticisms of ESG Investing

Hot on the heels of its meteoric rise, ESG investing still faces some challenges; one of the key objections revolves around a lack of standardized metrics for measuring ESG performance (one size does not fit all). Without universal standards or set ESG disclosure rules, it is difficult for investors to comparison companies operating in different industries and even within the same industry but located in various places. Greenwashing (where companies exaggerate or misrepresent their own environmental or social credentials) is also a huge problem, making it difficult for serious publicly listed companies to Engage with ESG investing.

In addition, some critics doubt that ESG investing always brings better financial performance. Such initiatives are time and money across the board to those involved from managers to employees on frontlines or executives back in headquarters. They are also expensive in their own way: Gen vest Area Source Costs Incurred from Establishing an ESG Report Card with the Compliance Shop C2 Level Management Sy After putting the matter that way, it is only located between the findings of social psychology and common sense to say inconclusively that ESG investing delivers better financial returns than traditional forms of investing.

Another view is that implementing ESG guidelines limits one’s potential investments in a given market or even as a transitory phenomenon leads to lower returns. If all companies only need to meet the ESG criteria at their own level of performance while playing it safe—this will push upwards on employment and environmental standards without any regulations at all.