The utilization of financial ratios offers a robust framework for evaluating a company’s overall financial well-being and performance. By distilling complex financial data into readily interpretable metrics, these ratios provide stakeholders with actionable insights that inform strategic decision-making. The strength of financial ratios lies in their capacity to provide nuanced interpretations of numerical data, which are grounded in established accounting standards. As such, they constitute an indispensable tool for entrepreneurs, managers, and investors seeking to make informed, data-driven decisions.

Financial ratios provide a contextual foundation for assessing business performance, as they establish a framework for comparing key financial metrics. In isolation, metrics such as revenue or net income are insufficient for evaluating a company’s financial health; rather, they must be considered in relation to costs, assets, and industry benchmarks. Financial ratios bridge this information gap by establishing relationships between essential financial indicators. For instance, the current ratio offers a snapshot of a company’s short-term financial stability by comparing its current assets to liabilities. A current ratio of 2.0, for example, indicates that a company possesses twice the amount of short-term assets as liabilities, thereby providing reassurance to suppliers and creditors. On the flip side, if the ratio falls below 1.0, it could be a red flag for potential cash flow problems, which would require a closer look.

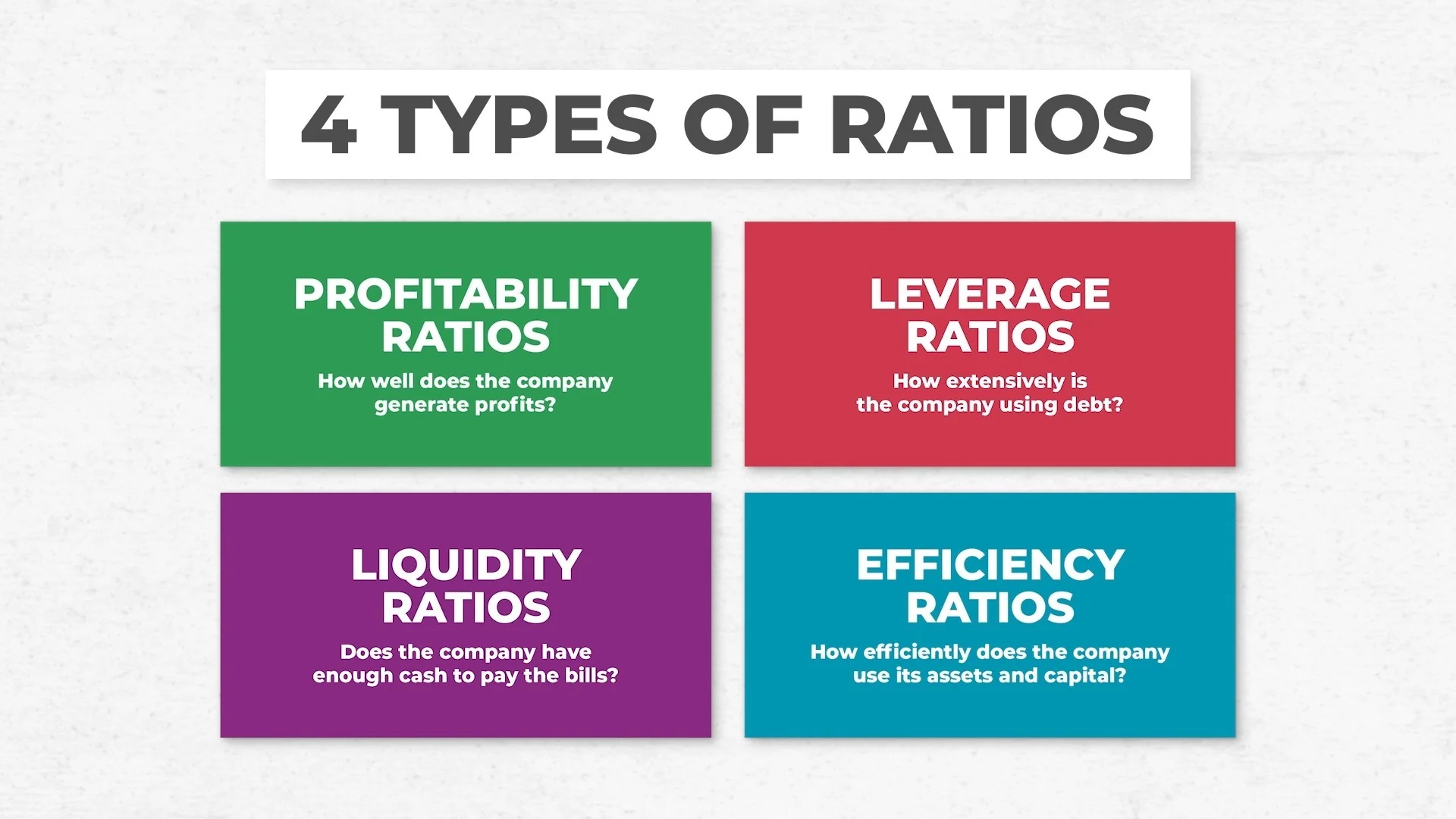

The examination of profitability ratios is crucial in determining an organization’s capacity to generate profits from its revenue streams. Meanwhile, the net profit margin offers a clear snapshot of how much of your sales revenue is actually profit, after factoring in all the costs of running the business. For example, a net profit margin of 10% indicates that a company retains ten cents from every dollar generated, offering valuable insights into its operational efficiency and profitability. By leveraging these ratios, businesses can gain a deeper understanding of their financial performance and make informed decisions to drive growth and improvement.