People often think about financial readiness in terms of goals, like saving for retirement, buying a house, or paying for school. But life doesn’t always go as planned, and things that you didn’t expect often happen. Being able to handle money problems can make the difference between being strong and having a crisis, whether it’s losing your job suddenly, having a medical emergency, or a global event that shakes up the markets. Getting ready for the unexpected doesn’t mean trying to guess every possible outcome. It means building a base that lets you be flexible, stable, and make smart choices when the stakes are high.

Liquidity is at the heart of being financially ready. Having cash or assets that can be quickly turned into cash protects you from sudden changes. This doesn’t mean saving money or avoiding investments; it means finding a balance between growth and accessibility. For instance, a business might keep some of its money in short-term investments or have a line of credit to cover problems that come up in the course of business. People also benefit from having an emergency fund that can pay for their basic needs for a few months. Having liquidity gives you peace of mind and buys you time, which is often the most valuable thing you can have in a crisis.

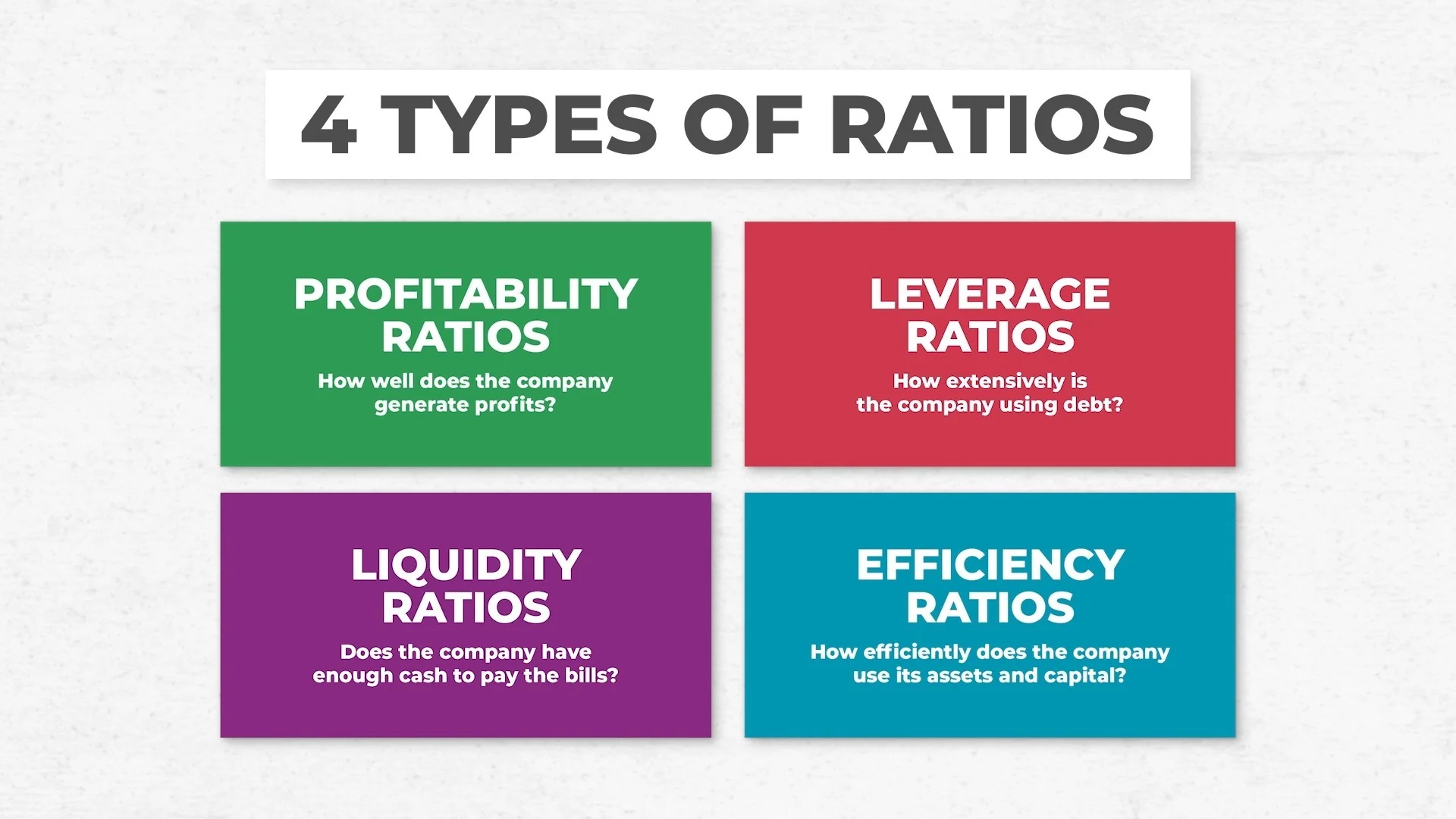

Another important part is knowing how your finances work. It’s not enough to just know how much money you make and spend; you also need to know what your debts, assets, and weaknesses are. You have to make decisions quickly when things don’t go as planned. If you know which costs are set in stone, which can be put off, and which assets you have, you will be more confident in what you do. For businesses, this could mean keeping their financial statements and cash flow projections up to date. For people, it could mean looking over their budgets and debts on a regular basis. Being aware is the first step to being in charge.

Insurance is an important part of being financially ready, but people often forget about it until they need it. These tools, like health, property, life, or business interruption insurance, are meant to lower risk and give you money when things go wrong that you can’t control. The hard part is picking coverage that matches your real risk. Too much insurance wastes resources, and not enough insurance leaves holes. A careful review of policies, preferably with the help of a professional, makes sure that protection is both good and cheap. Insurance doesn’t protect you from all problems, but it can help you deal with them better.

Another principle that helps resilience is diversification. Putting too much faith in one source of income, investment, or market can make you more vulnerable. When something unexpected happens, having a variety of assets and income streams gives you choices. If one area of a business’s product lines or geographic markets starts to fail, the business can change its focus. A person who has stocks, bonds, and real estate can change their portfolio to keep its value. Diversification doesn’t get rid of risk; it just spreads it out, which makes any one disruption less important.

Communication is a part of being financially ready that people don’t always think about. When things are uncertain, clear and timely communication with stakeholders like employees, customers, lenders, or family members can keep people from panicking and help them work together. Businesses that are open and honest during hard times often keep their customers’ trust and loyalty, which can be very important for getting back on track. People who talk about their financial plans with their partners or dependents make sure that everyone is on the same page and knows what’s going on. When things happen that you didn’t expect, it can be hard to connect with others. But talking to each other can help you understand each other and build a connection, which are both important for getting through tough times together.

Technology can also make you more ready. Digital tools for budgeting, forecasting, and monitoring give you real-time information that helps you make decisions ahead of time. Automated alerts, dashboards, and scenario modeling can help find problems before they get worse. Businesses can make their infrastructure more responsive by connecting their financial software to their operational systems. For people, using apps to keep track of their spending or investments can make it easier to keep an eye on things and spot trends. Technology doesn’t take the place of judgment; instead, it strengthens it by giving you data and structure when you need it most.

Mindset is probably the most powerful but least tangible thing that affects how ready you are for money problems. If you see money as a tool instead of a source of stress, you can respond in a more logical and strategic way. People who are curious and flexible about money tend to do better when things don’t go as planned. They are more open to changing their minds, changing their plans, and asking for help. A growth mindset, which sees problems as chances to learn, can turn a financial crisis into a turning point. Companies that encourage this kind of culture often come out stronger because they used the disruption to come up with new ideas or make things run more smoothly. People who accept it may find new habits, priorities, or paths that work better for them in the long run.

In the end, getting ready for the unexpected is all about being strong. It’s not a list of things to do or a one-time thing. It’s a constant process of being aware, making plans, and being flexible. It needs to be both structured and flexible, and it needs to be both logical and understanding. The goal isn’t to get rid of uncertainty; it’s to be ready for it. This means having the right tools, resources, and attitude to respond clearly and with confidence. In a world where things are always changing and surprises are always around the corner, being ready for anything is not only a safety measure but also a strategic advantage. It helps businesses survive and grow, and it makes it easier for people to deal with the ups and downs of life.